How to Read Routing and Account Number on a Check

How To Read a Check: Easily Find Your Account and Routing Numbers

- When To Employ a Bank check

- Parts of a Bank check

- Why Use Checks

- Takeaways

With the advent of Paypal, Venmo and Bitcoin, checks seem so terminal century, but that doesn't mean you no longer demand to know how to read a check for cyberbanking information.

You might be surprised that in 2018 — the most contempo year for which statistics are available — there were however 14.5 billion check payments written, according to the Federal Reserve Board. At the bottom of your check, you'll come across three groups of numbers. Your routing number is in the starting time group, your account number is in the second, and your bank check number is in the third group.

When To Use a Cheque

Some online transactions crave an agreement of how to read a check and where to look for important information. For example, you might need data from your checks to gear up up direct deposit or arrange an electronic transfer direct into your account. To do either of these, you lot need to know how to decipher your check account and routing numbers.

Reading a check is simple, but to empathise how to read a check and differentiating betwixt routing and business relationship numbers, or how to read a government bank check and set upwards straight deposits, use the following illustrated guide to acquire.

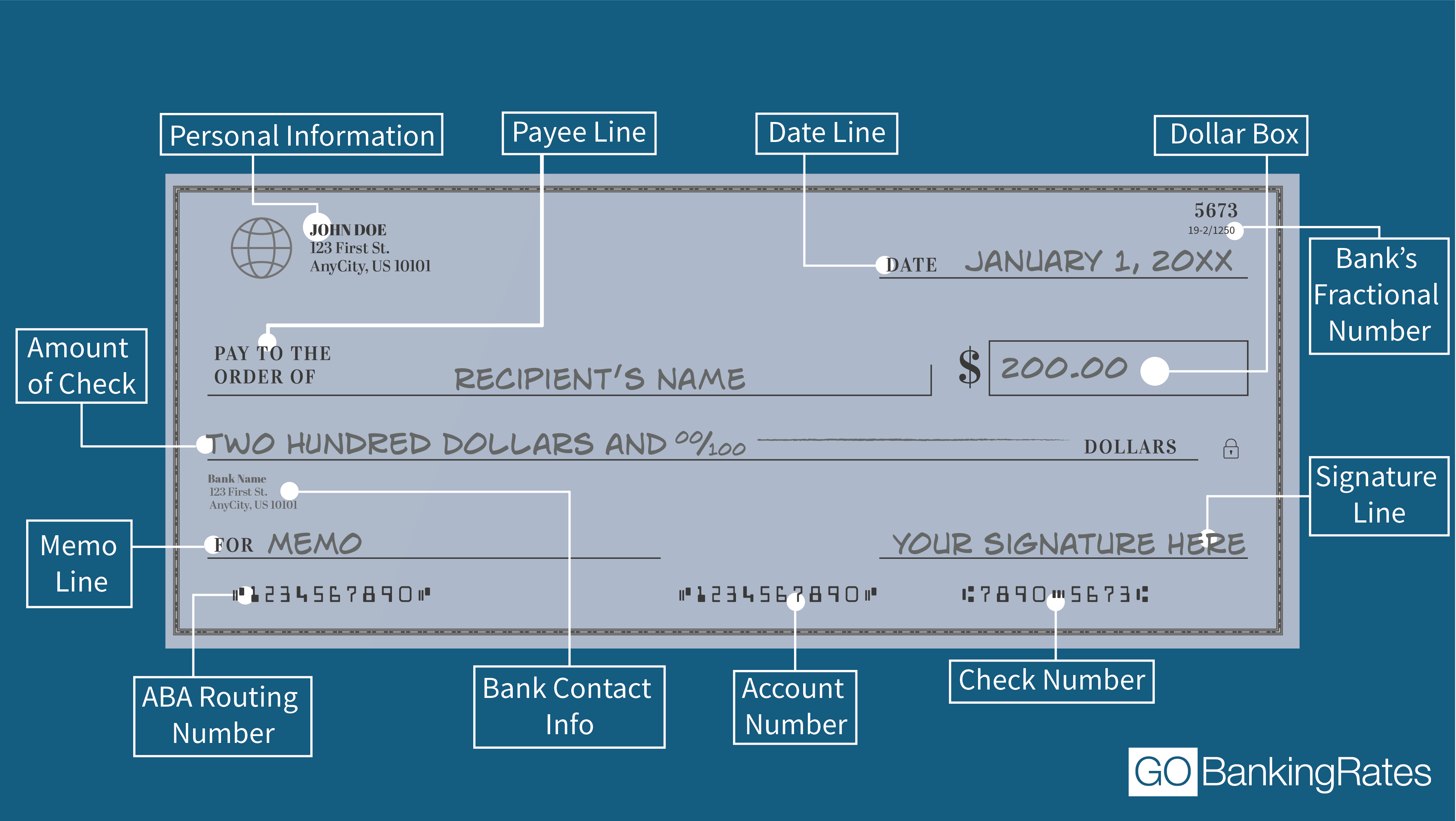

What Are the Parts of a Bank check?

Here are the different parts of a cheque.

1. Personal Information

In the upper left-hand corner of the check, you'll find the personal information of the person to whom the business relationship belongs. This typically includes their name and address.

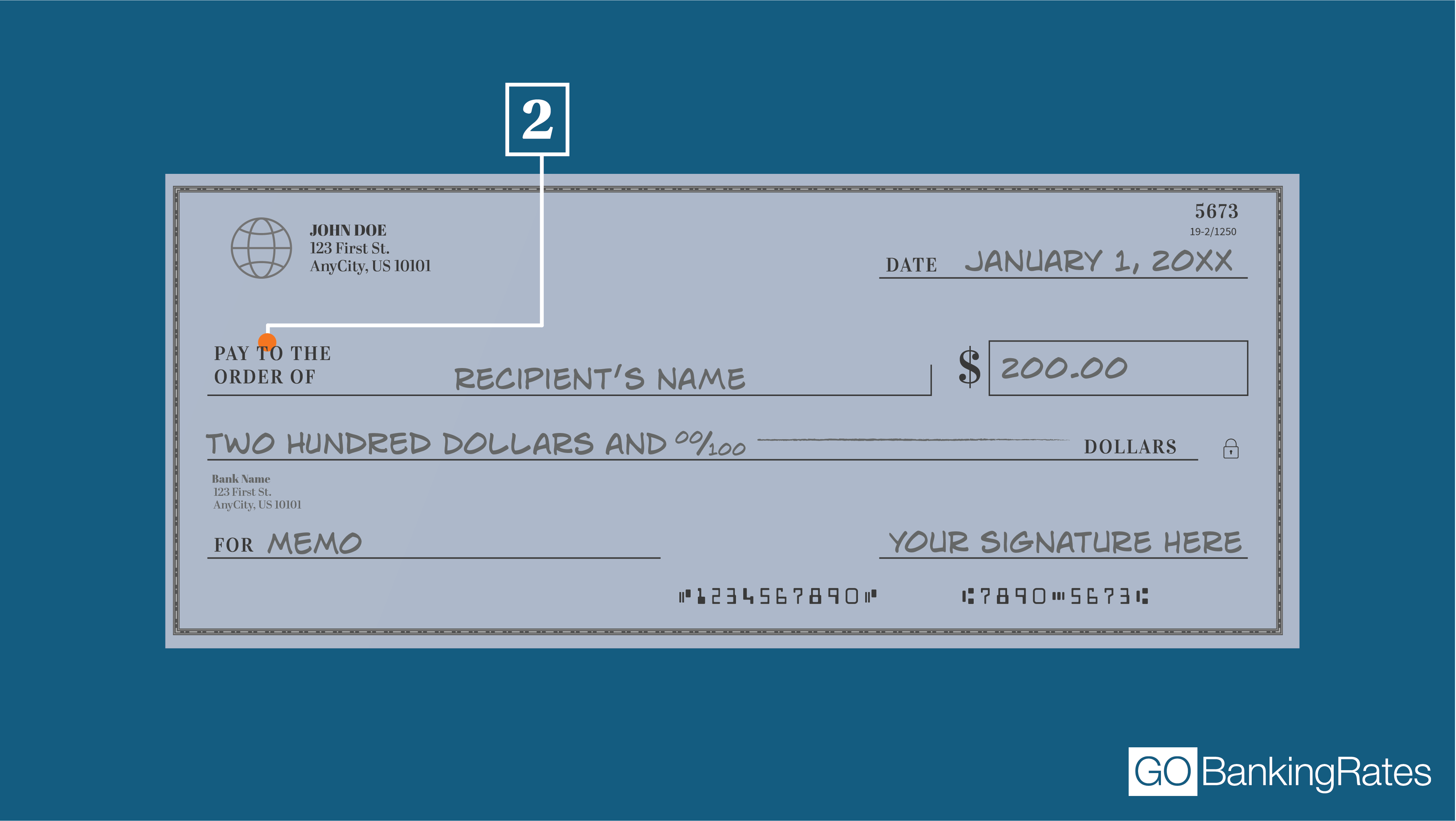

2. Payee Line

On the payee line, you'll find text that reads "Pay to the social club of." This is the person or business to whom the money will be paid. If the check is made out to you, then y'all're the payee. You'll need to endorse the check by signing the back when yous're fix to cash information technology. Don't endorse it until y'all are ready to cash or deposit it.

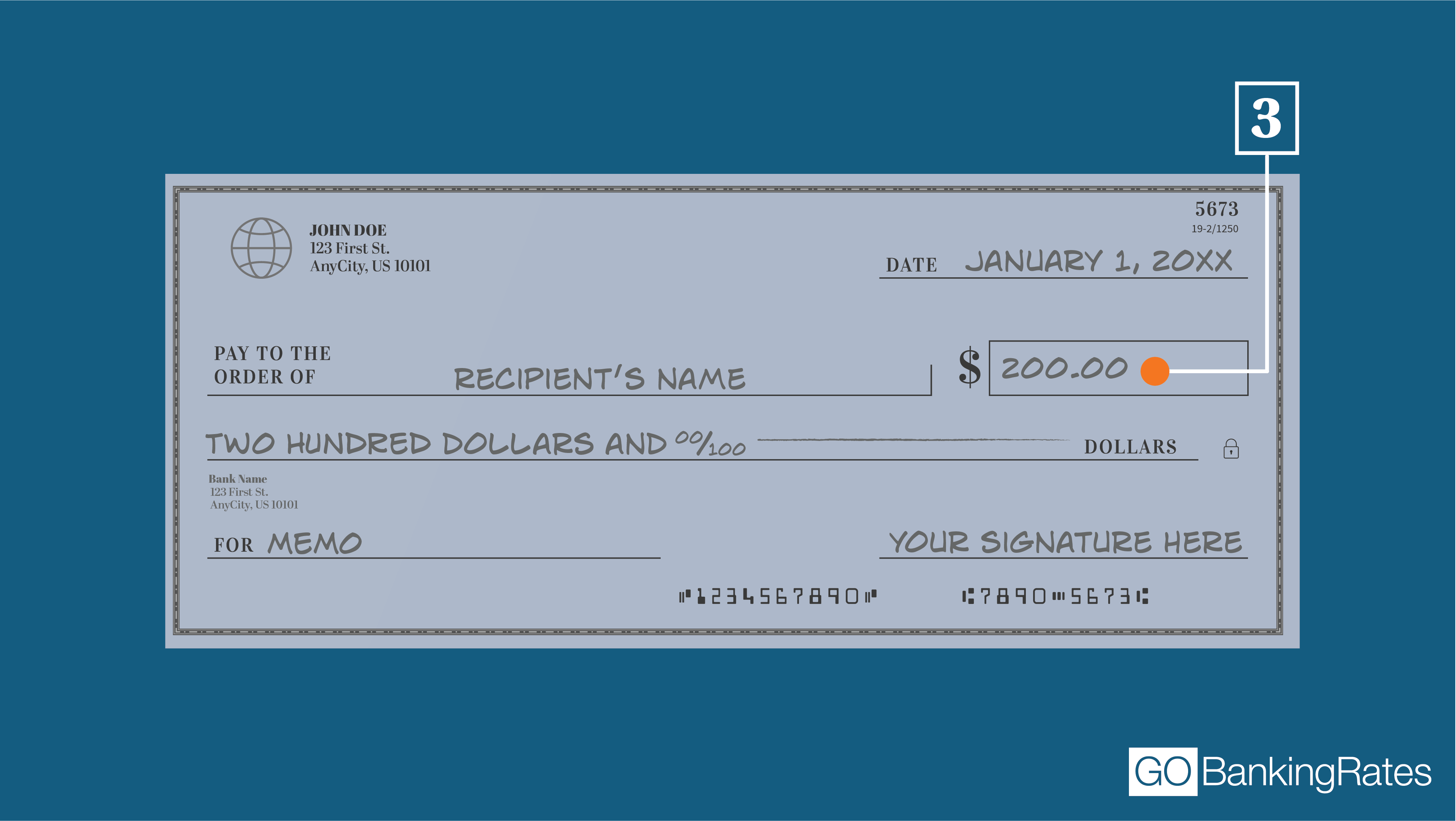

iii. The Dollar Box

Within the dollar box, you'll discover the amount that the check is worth written in numbers. Write your amount like this: $20.65.

Begin writing as shut to the left side of the box every bit possible with the dollar sign snug against the first number. Yous don't desire someone to alter the check to $2220.65.

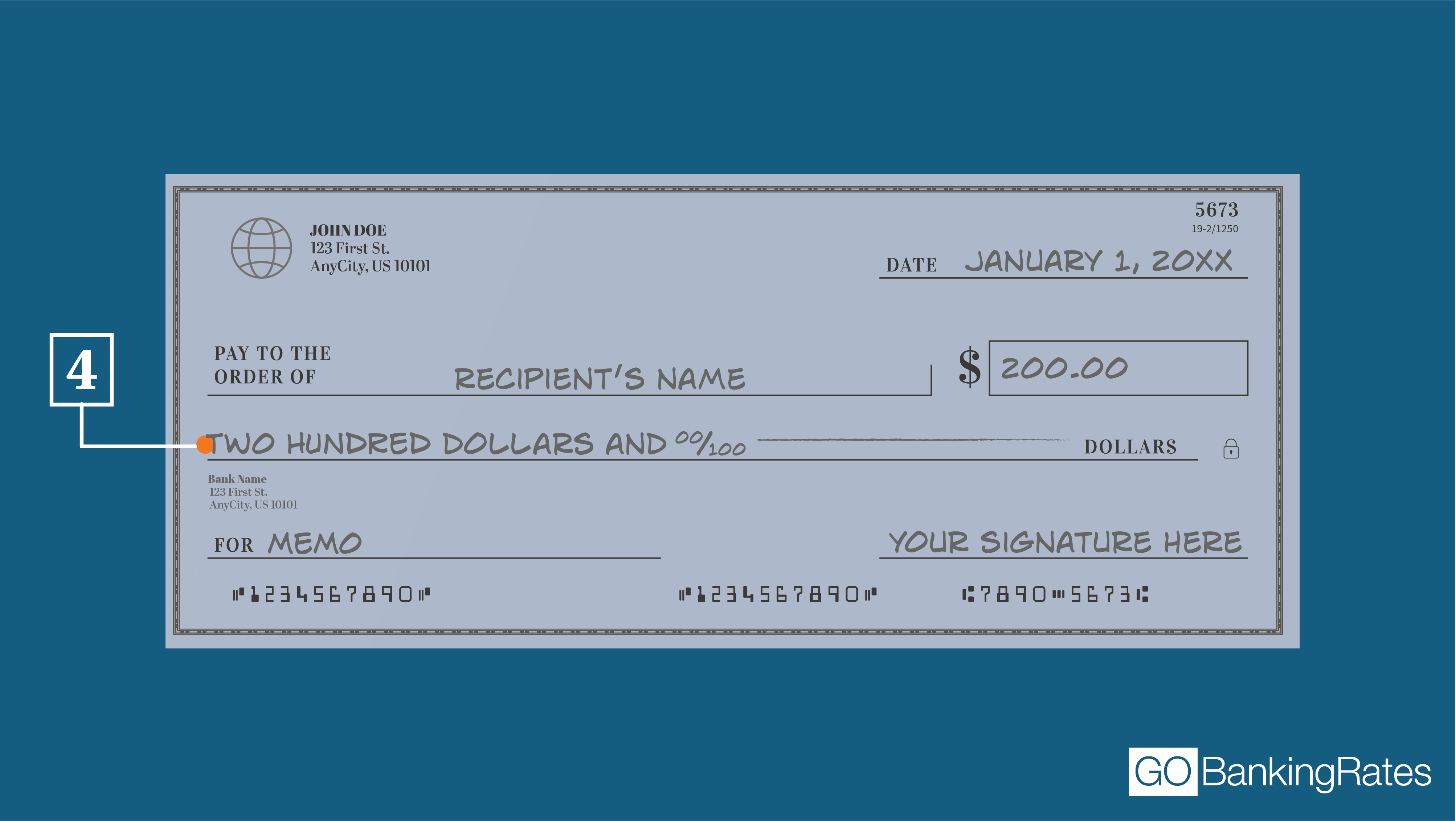

iv. The Amount of the Cheque

Write the dollar corporeality out in words on this line, which is beneath the payee line. The cents, however, volition still be in number format. For example, the amount line would say "Twenty dollars and 65/100" for a check that amounts to $20.65. It must match the corporeality in the dollar box.

If there is any room left over on this line once you've written out the total amount, you can strike through the remaining space so that no one can adjust the corporeality without your knowledge.

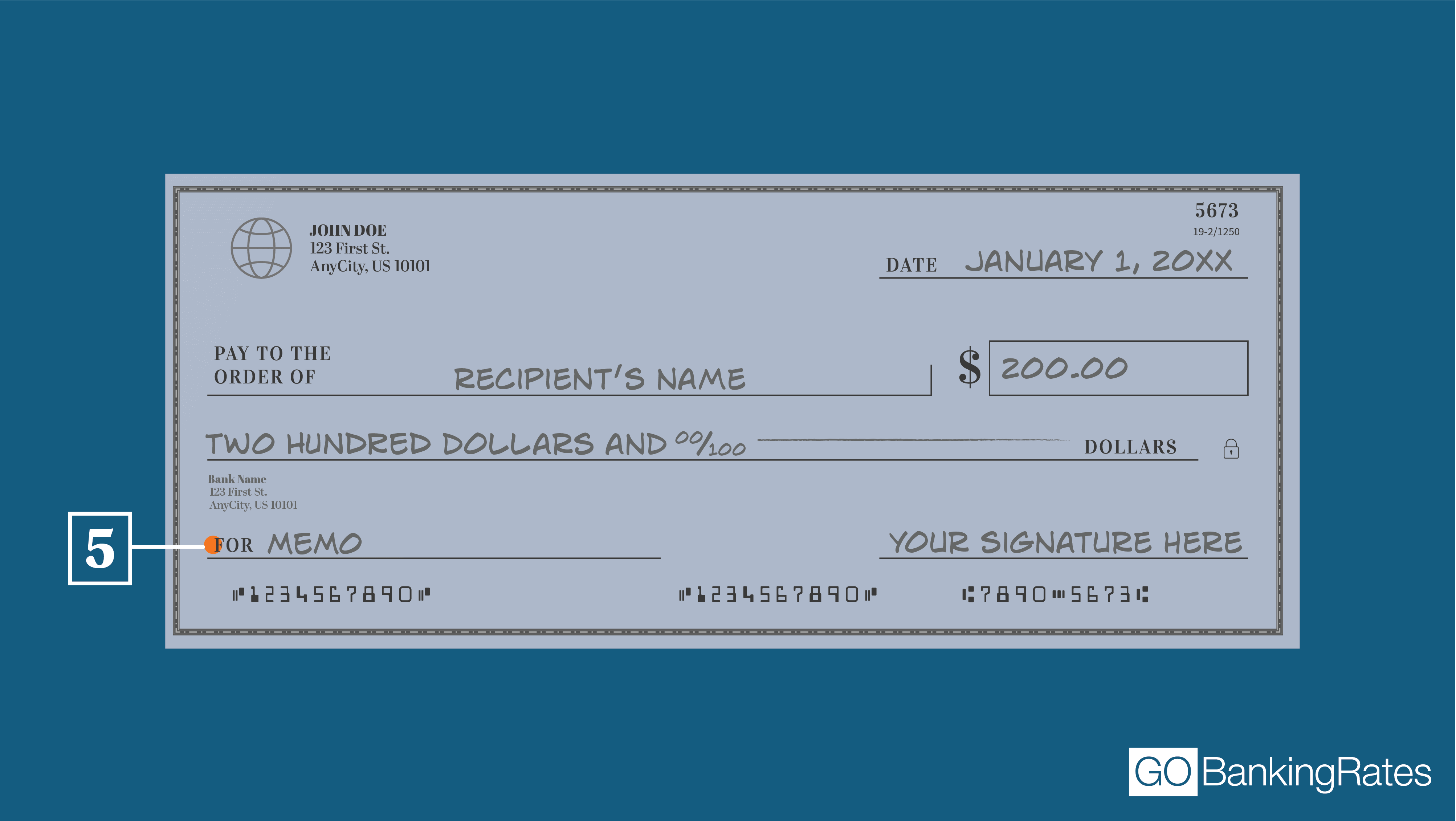

5. Memo Line

The memo line is optional, but it's skilful practice for keeping rail of cheque payments. The memo line is used to signal the reason for the transaction. For case, a renter could write "March 2021 rent" on the memo line when writing a check to the landlord.

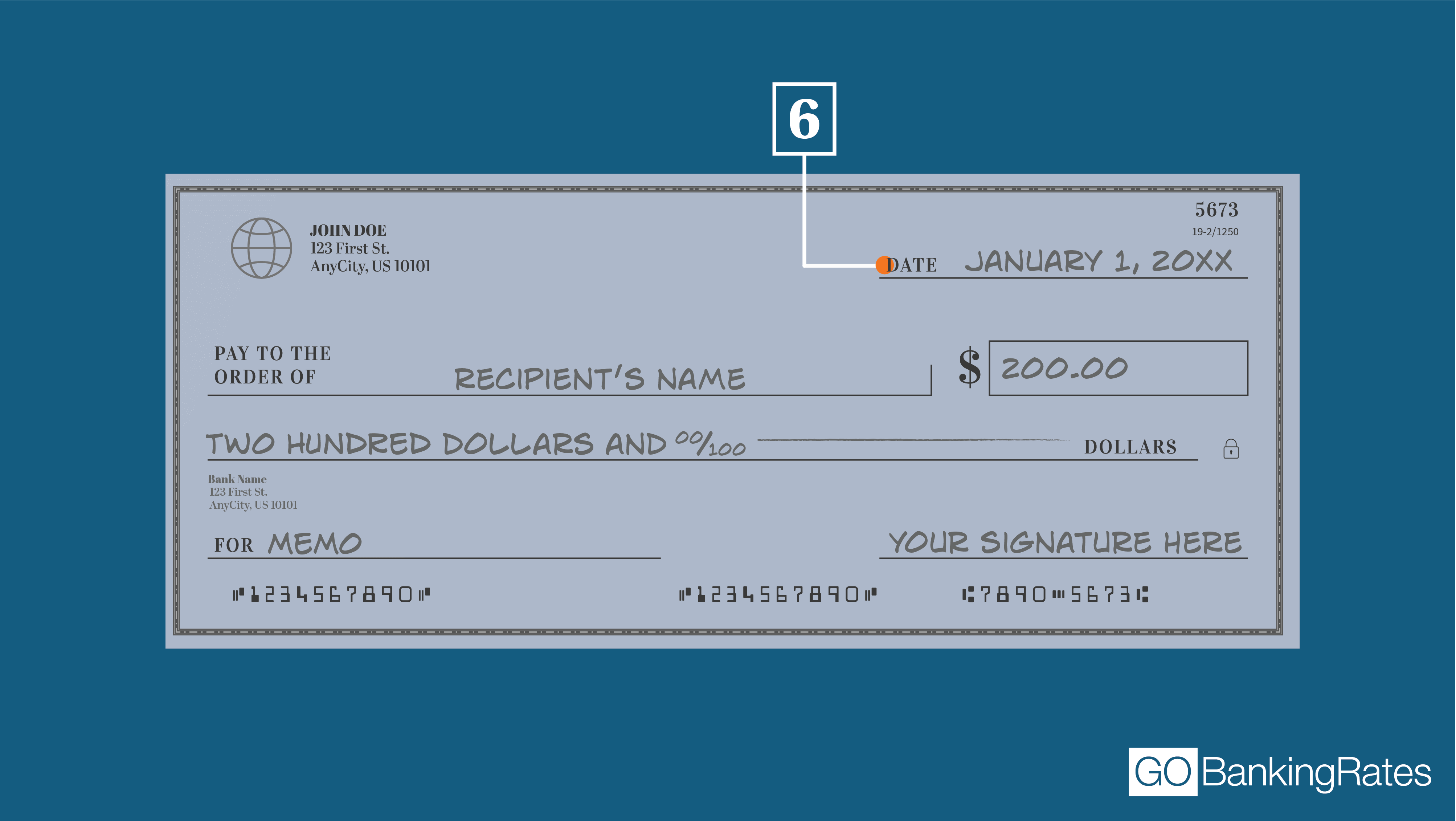

vi. Date Line

On the appointment line, you'll detect the appointment the cheque was written.

Sometimes, the paying party might postdate the bank check to indicate when the payee should cash information technology. For example, you might make out a bank check on March five, but write March 15 in the date line. This often is done if business relationship funds won't be available until a specified future time.

Although the payee potentially could take this as a direction to wait earlier cashing a cheque, the check is valid from the moment information technology's signed past the issuer. The payee doesn't accept to await until the date on the date line to cash the check. If the payee attempts to cash the check before the date on this line and the cheque bounces, the person who wrote the check and the one who cashes it could face fees from their banking concern.

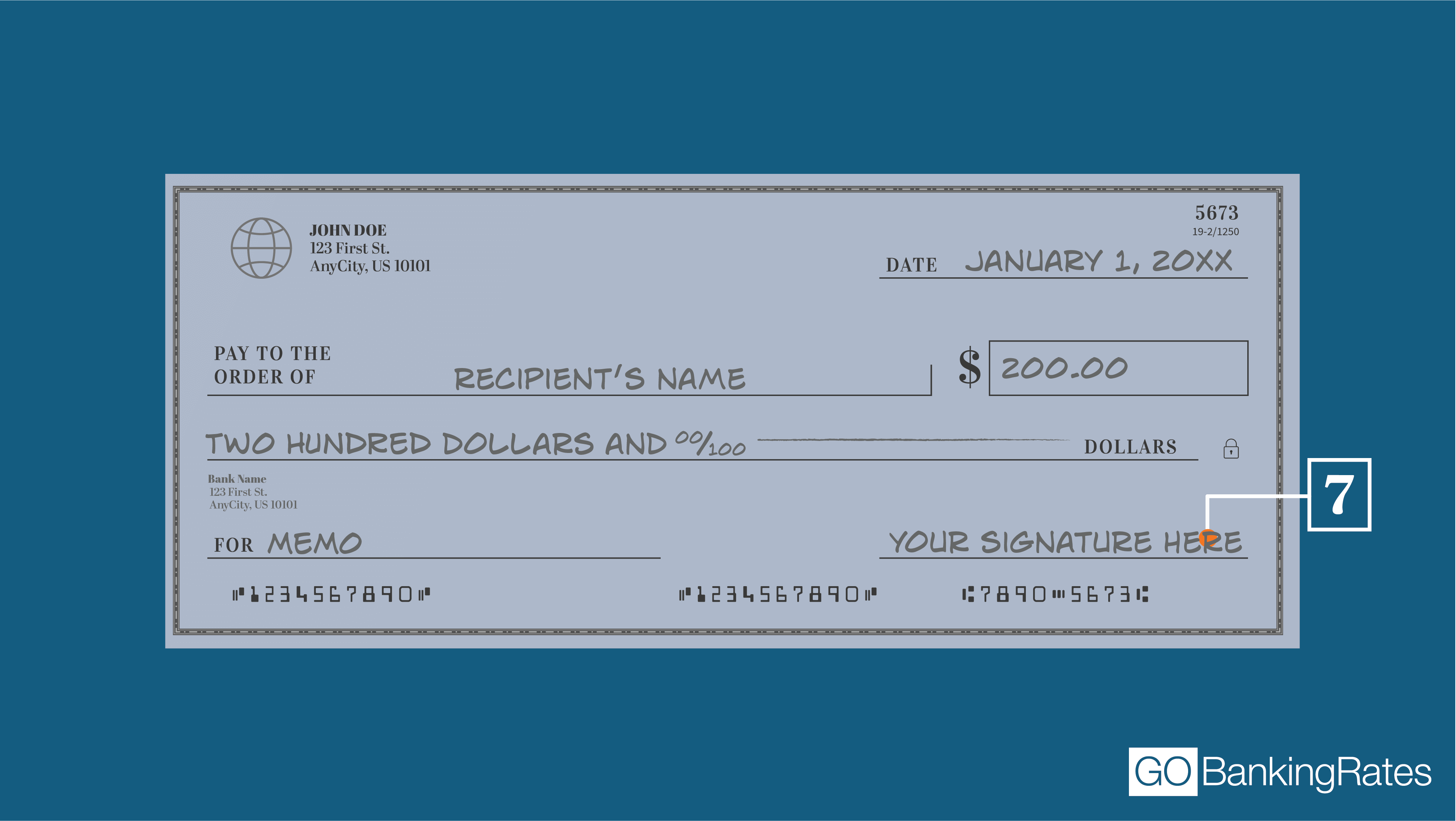

7. Signature Line

The issuer volition sign this line to authorize the check.

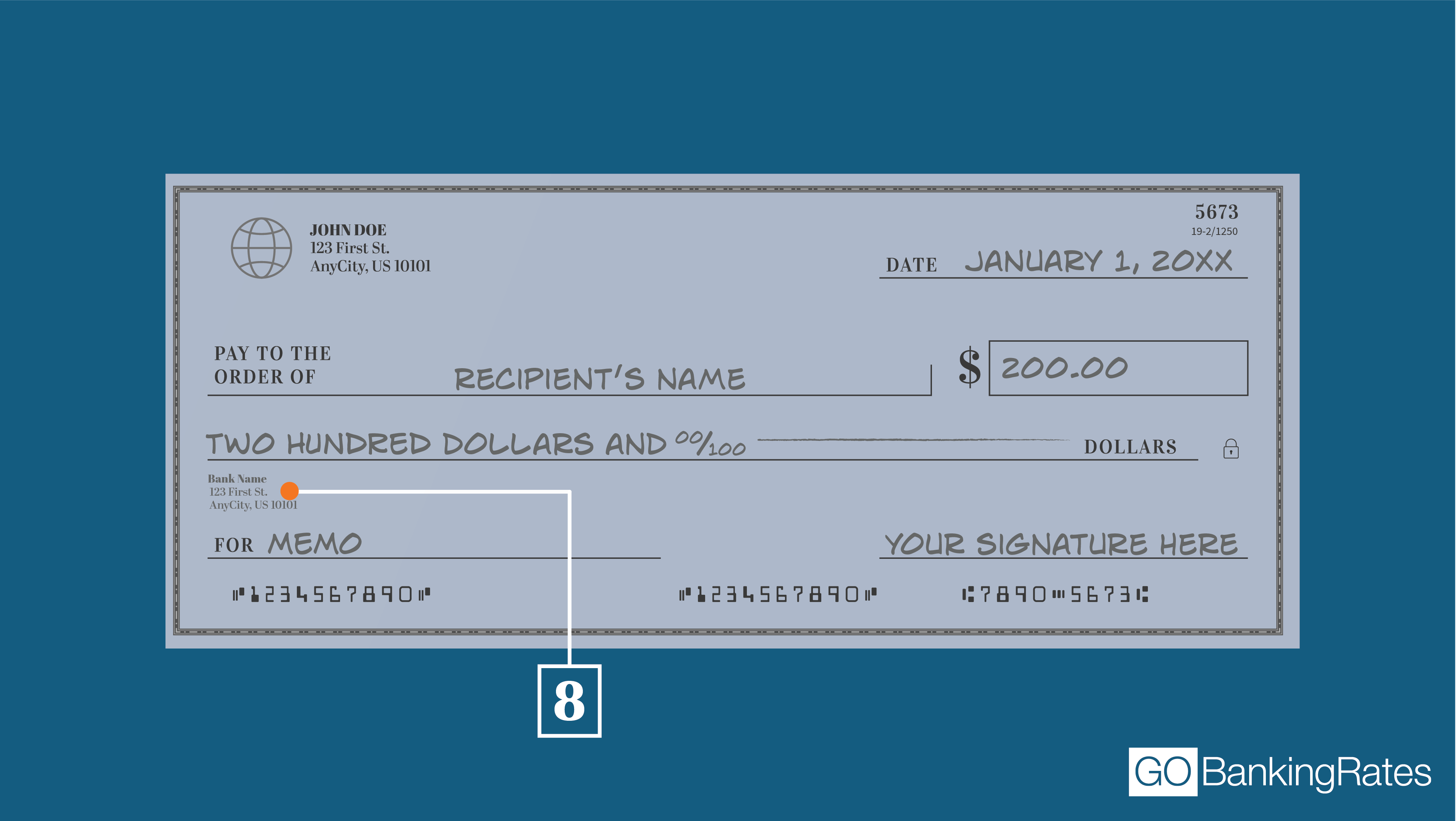

8. Bank Name

If you take any questions or concerns about a check, you lot can contact the banking concern that is listed on the check.

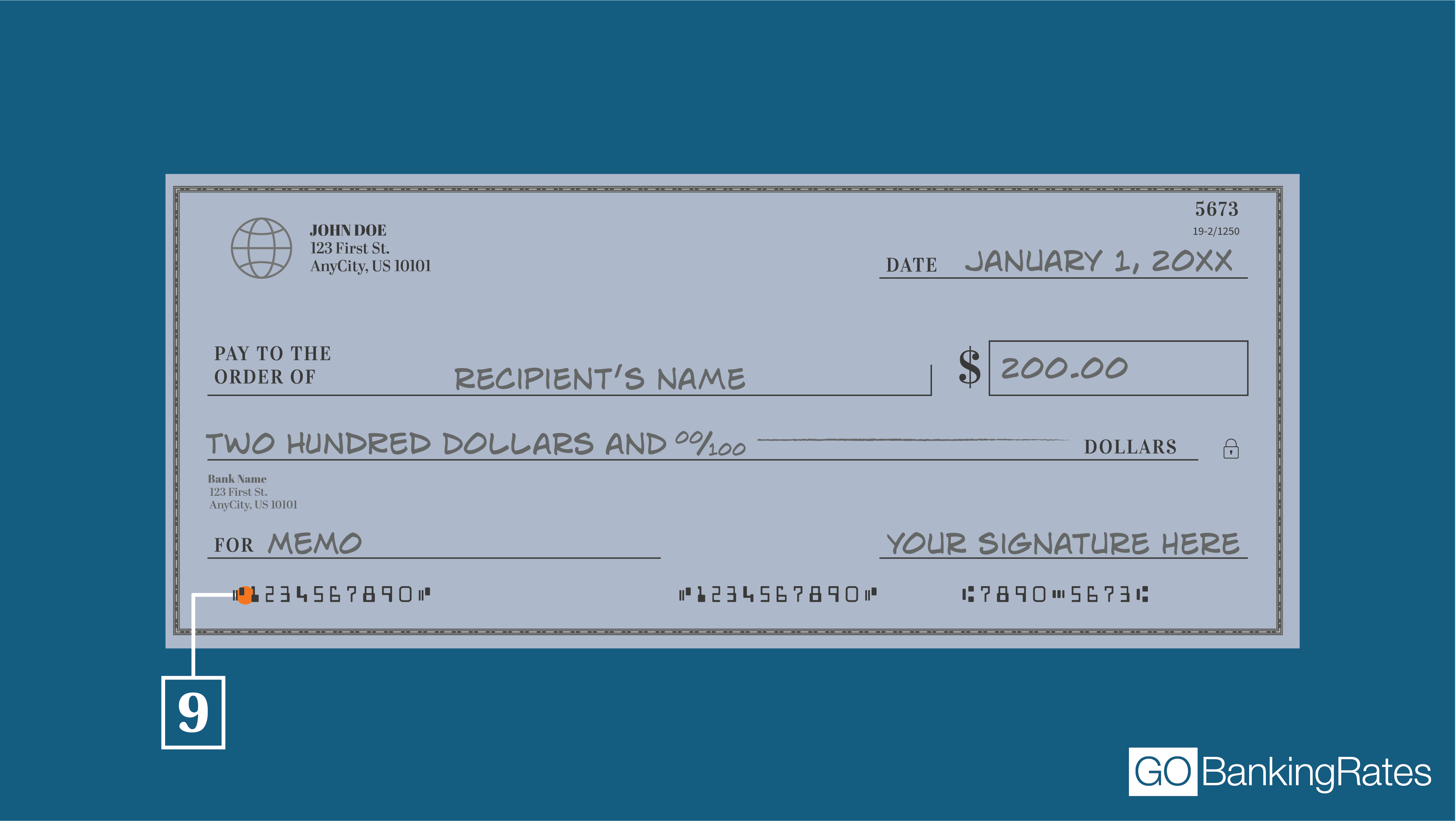

9. Bank's ABA Routing Number

The ABA routing number is a ix-digit number assigned to your bank by the American Bankers Association. This indicates the bank through which the funds volition exist withdrawn.

You'll also apply your ABA routing number to ready directly deposit and recurring payments. Some banks will have more than one routing number depending on their size, and then always make certain yous're using the correct routing number before setting up these types of payments.

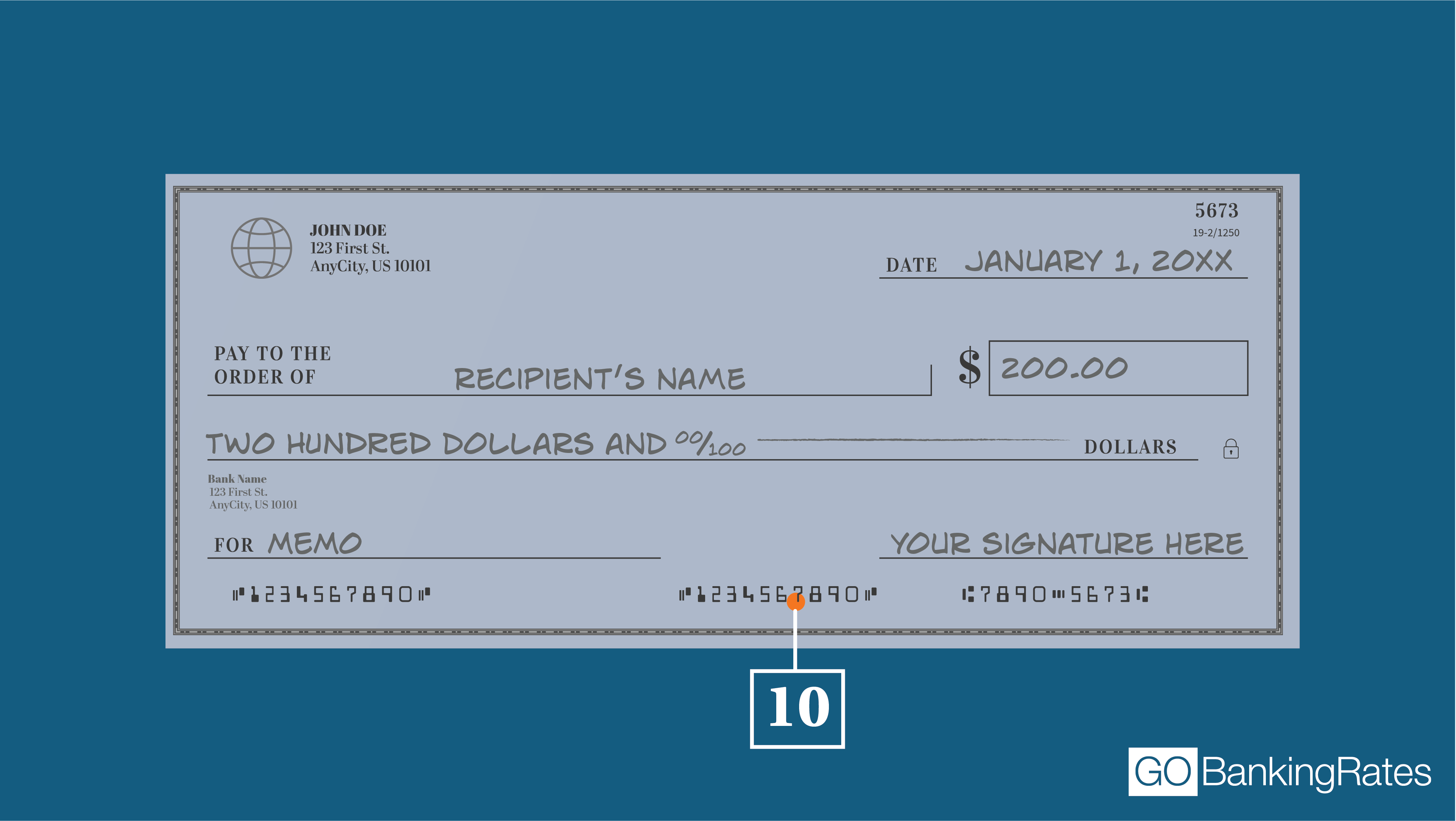

10. The Account Number

This is the number that's associated with the checking account from which the funds volition be withdrawn. It is the second fix of numbers printed at the lesser of your checks. The routing number is offset, at the far left.

11. Bank check Number

The check number is used to identify the individual check. That fix of numbers is located at the far correct forth the bottom of your checks.

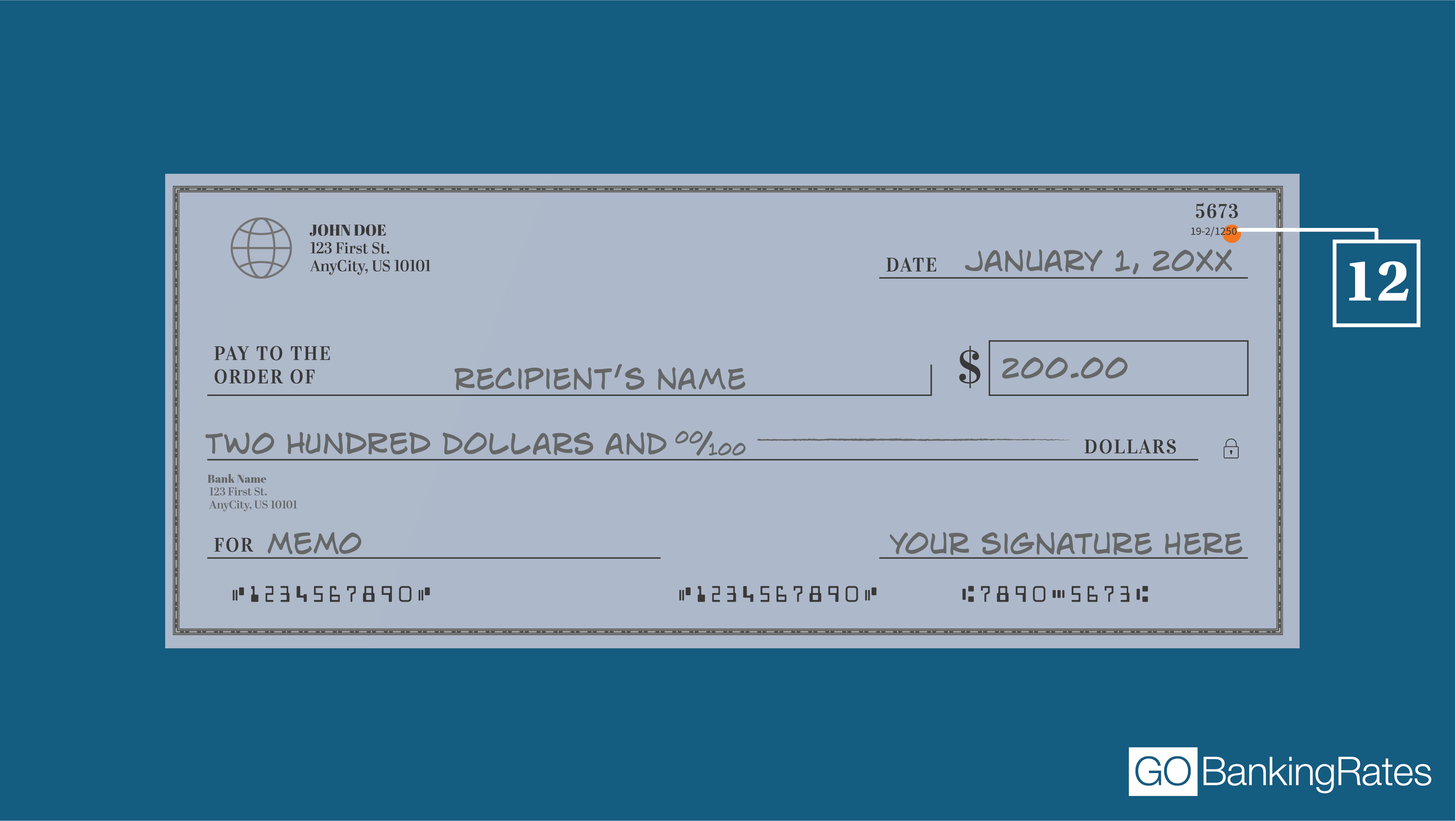

12. Bank'southward Partial Number

The fractional number, usually placed toward the top correct of your check, contains numbers that correspond with your bank, such equally your routing number. Because these numbers are readily available elsewhere on the check, the fractional number isn't widely used anymore.

You might find that the routing and business relationship numbers at the bottom of the bank check await like symbols. It's a special font known equally magnetic ink character recognition, or MICR. This special ink can exist read past check-sorting machines.

Reading a Check Is a Useful Skill To Accept

If yous learn how to read check details on a personal business relationship, you'll besides know how to read a cashier's bank check and how to read a concern business relationship check.

Why Checks Are All the same Useful

- Not everyone knows how to use cash apps, and some people don't have a mobile telephone or figurer.

- Some people but similar the simplicity and time-tested reliability of writing a check.

- When compared with cash, checks are much more than secure. If your wallet is stolen, your cash is probably as practiced as gone. If you're sending money as a birthday gift, you'll risk losing that greenbacks in the mail service.

I drawback of checks is that anyone who gets their easily on one of your checks now knows your name, address, bank data and account number.

Key Takeaways

Demand to know your routing number and don't take a bank check handy? You tin as well find your routing number past:

- Using the ABA routing number lookup tool

- Checking your bank's website

You as well can notice your bank business relationship number on your cyberbanking statement. If all else fails, y'all tin can call or visit the bank to find out the routing and account numbers.

No matter how you lot prefer to do your banking, existence able to read a cheque is a good skill to take in instance you might run into a situation where checks are the all-time or only valid grade of payment.

This article has been updated with additional reporting since its original publication.

stampleyweref2001.blogspot.com

Source: https://www.gobankingrates.com/banking/checking-account/how-to-read-a-check/

0 Response to "How to Read Routing and Account Number on a Check"

Post a Comment